When Pope Francis speaks about the global economy, capitalism or even the discipline of economics, most of us have little or no inkling of what he and most other middle-class, thoughtful Argentines went through during their lifetimes. Clearly, “stranger than fiction” is an understatement.

In the United States, major policy changes relating to taxes, government spending, monetary policy and banking regulation have been rare, slow-paced and gradual. Big-ticket domestic spending programs, like the introduction of Social Security by President Franklin D. Roosevelt, of Medicare and Medicaid by President Lyndon B. Johnson and of the Affordable Care Act by President Obama, came several decades apart. The same was true for tax cuts engineered by Presidents Kennedy, Johnson and Reagan. Major exceptions were few and far between: the short-lived price controls of President Richard Nixon, the abrupt tightening of money supply by Federal Reserve Chairman Paul Volker in 1979 and the massive quantitative easing policy of the Federal Reserve after the 2008 financial crisis. The same is true for trade policy: the Kennedy-round tariff reductions and the free trade pacts with Latin America and Asia came about only after much debate. In our country most economic policy change is slow and gradual and is based on some level of consensus. We also live in a decentralized society. While decisions are made in Washington, D.C., there are major commercial and financial centers across the continent. Academic advisors come from all over.

By contrast, Argentines have experienced a very different form of capitalism. A democratic wasteland for many decades, major changes were mostly guided by outside experts or economic technocrats. Unfortunately, such a tyranny of experts, as Bill Easterly of New York University notes, is common in developing countries, often going hand in hand with foreign aid packages from the United States, the United Nations, the World Bank or the International Monetary Fund.

Several major episodes took place in Argentina during Pope Francis’ lifetime, amid the populism of the Peróns and the harsh abuses of dictatorships. When we hear him speak critically of capitalism and the discipline of economics in general, we can understand that his views reflect almost any reasonable person’s reaction to recurring tyrannies of military dictators and technocratic experts.

A Changing Nation

Pope Francis was born in 1936 during the depression era in Argentina. Then and later during World War II, Argentina was cut off from importing manufactured goods from the rest of the world. So Argentina began to industrialize to substitute for imported goods. Argentina had to start producing more of the manufactured goods it needed, even if these goods were not going to be sold later on world markets. Economic isolation was not so much an available policy option at that time. It was a hard necessity.

After World War II, Europe was reconstructing and badly needed food supplies, both grain and beef, and Argentina was ready to fill that need. The country quickly became cash rich in export earnings, and the larger farm estates grew rich quickly. The labor unions grew as a political force. Before this, with little industrialization, most workers were in the rural sector.

Then came the political partnership and marriage of Eva Duarte and Juan Domingo Perón. The Peróns formed a fusion between the military and the working class against the agricultural elite. As Juan Perón became more and more popular as labor minister, he was jailed by higher authorities. Evita Perón led a countrywide strike of the “shirtless ones,” and Juan Perón was released. He then ran for president and won handily.

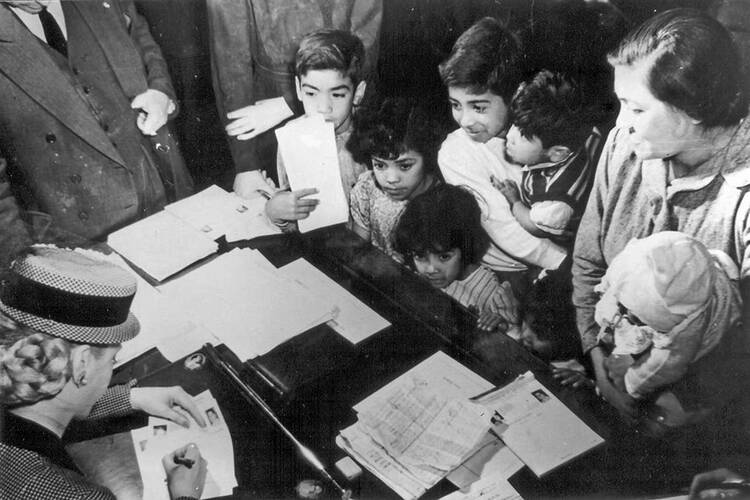

At this time, the Peróns put through many social expenditure programs for the working-class poor in Argentina. (A personal note: When I was working in Argentina over a decade ago, a Jesuit of the same age as Pope Francis sternly rebuked me when I chided him about his staunch Peronist support. He told me he was a child of Italian immigrants and would have had to quit school to work in a tailor shop, were it not for the Peróns. He was able to stay in school, go to government-sponsored soccer camps and then go on to the university. He then became a Jesuit, while a younger brother became a judge. Much as many elderly Democrats in the United States remember President Roosevelt and his wife Eleanor as transformative figures in their lives, many Argentines recall the Peróns with even greater fervor.)

Juan Perón was set to take his wife Evita as the vice-presidential candidate for his second term in the early 1950s. She had already gained women’s suffrage during his first term. But the military elders blocked him from doing so. The Eva Perón Foundation continued its social spending. She traveled to Europe to receive a medal from General Francisco Franco. But Eva Perón became ill in January 1950 and died of cancer in July 1952 at age 33, during her husband’s second term.

After his wife’s death, Juan Perón was at a loss. He tried to follow the same policies of government social largess, but European agriculture was in recovery and Argentina’s foreign exchange earnings were shrinking. He also had a personal scandal arising from an affair with a 15-year-old girl. There was a military coup against him, and he was excommunicated by the Catholic Church. He first fled to Panama, where he met an Argentine cabaret dancer, Maria Estella Martínez, better known by her stage name, Isabelita. From Panama he went to the Dominican Republic and then to Madrid, where General Francisco Franco offered him asylum.

St. John XXIII lifted the excommunication, and Mr. Perón and Isabelita were married in the Catholic Church. One of their bodyguards, José López-Rega, convinced Isabelita that she was destined to become Argentina’s new Evita.

The Post-Perón Interlude

During Juan Perón’s exile, Argentina was ruled by military dictators, with brief periods of democracy. During this time, one idea caught on like wildfire in Argentina and throughout Latin America. It came from Raul Prebisch, an Argentine, and Hans Singer, an Austrian, economists working at the Economic Commission for Latin America, a United Nations organization based in Chile. The Prebisch-Singer hypothesis forecast declining terms of trade for natural resource exports from Latin America to the North. This was due to new forms of synthetic substitution, for example polyester for raw cotton, as well as the greater use of recycling methods for steel. This hypothesis created and framed the economic notion of “elasticity pessimism.” It asserted that as the northern countries grew, there would be less demand for commodities and natural resources from South America. Expenditures would shift from imports to services in the more developed countries. While this thesis was intuitively compelling, it was never empirically verified.

The major policy implication of the Prebisch-Singer hypothesis was to promote what was called import substitution industrialization. Countries like Argentina could grow and develop only if they imposed high tariffs and quotas on imported manufactured goods to develop their own homegrown industries.

This policy quickly led multinational corporations to open branches in Argentina. If the Ford Motor Company could not export cars to Argentina, why not produce the cars in Argentina? Tariff-jumping is a major reason for the growth of multinationals. Of course, Ford and other multinationals would use yesteryear’s technology in the products they manufactured in Latin America. The market was limited and effectively locked in, thus free of competition.

The first phase of import substitution industrialization, known as Structuralism I, at first seemed to be a success. But soon enough, the new industries realized that their domestic markets would soon be saturated. There was too little domestic demand to sustain them if they stayed locked into their home countries.

The next phase was Structuralism II. Seeing the beginnings of the European Common Market, Latin American countries had the idea of creating a series of common markets in their region. Examples were the Latin American Free Trade Area and the Pacto Andino in Lima. But Structuralism II did not help much. Unlike the European Common Market, with its fully developed road and rail networks, Latin American countries faced natural barriers to trade, like the Andes Mountains and the Amazon jungle, and had little infrastructure linking them.

By the late ’60s, import substitution industrialization had run its course. Stagnation and inflation were taking hold, and disgruntled Argentines looked back to the glory days of Mr. Perón. Many made visits to his apartment in Madrid to consult about politics back home. At this time, Marxism was gaining in popularity among young people worldwide, and Argentina was no exception. Followers of Mr. Perón split into two groups: traditional Catholics, who saw Peronism as the embodiment of Catholic social teaching, and Marxist Peronists, who saw in Peronism a path of Marxism Argentine-style. Both types made visits to their leader in Madrid.

In 1973 Juan Perón returned to Argentina and was elected president, with Isabelita as vice president. After one year in office, he died, and Isabelita became president, with José López-Rega, her bodyguard, as her chief advisor. As the Peronist movement became more and more divided, Mr. López-Rega initiated civilian militias, equipped with Uzis imported from Israel, to handle the Marxist Peronists. Here the military intervened. A military estate, especially one that has ruled in the past, cannot abide an armed civilian militia. The military deposed Isabelita Perón and took over the “dirty war,” killing the Marxist elements. This was March 1976.

No one knows how many were killed by the military during this period. Most agree that official estimates are far below actual numbers. The Catholic hierarchy did little to protest the human rights abuses. It was at this time that Jorge Mario Bergoglio served as provincial superior of the Jesuits in Argentina (1973-79).

The New Orthodoxy in Economics

At this time the so-called Chicago boys arrived. At the University of Chicago, Prof. Arnold Harberger regularly recruited talented young economists to study there under grants from the Ford Foundation. Tio Alito, as the Latin American students called him, took special care of them. Mentoring their doctoral work in public economics, monetary policy and trade theory, he often acted as a consultant for them when they returned home and assumed positions of authority in the central banks or ministries of finance. After the coup against Isabelita Perón, José Alfredo Martínez de Hoz, the new finance minister, appointed many of Professor Alito’s students to key positions in the Ministry of Finance and the Central Bank of Argentina.

The main task of the Chicago boys was to open up the country to free trade, to open the markets in finance and to make domestic markets more flexible and competitive for labor and for goods. The military dictatorships in Chile and Uruguay also made good use of the Chicago boys at this time. The regime changes were known as the Southern Cone experiments. Brazil, also under military dictatorship, did not adopt such extreme policies.

Key elements of these new policies were appreciation of the exchange rate while reducing tariffs, making imports less expensive and removing limits on international borrowing. The Eurodollar banks in London, now awash in petrodollar deposits from O.P.E.C. countries, were all too eager to send funds to the Southern Cone countries newly open to international trade and finance. The military governments added to the moral hazard of the economic policies by providing official guarantees to the investments made by the foreign banks awash in dollars.

The “original sin” of the financial deals at this time was that the debts were denominated in U.S. dollars and thereby linked to the U.S. interest rate. By a stroke of bad luck for the Southern Cone, in 1979 Paul Volker assumed the leadership of the U.S. Federal Reserve Bank and took on reducing inflation in the United States. He turned to abrupt monetary tightening, which pushed U.S. interest rates up almost to 20 percent. Thus the U.S. dollar appreciated, and the U.S. economy and most of the world went into a recession.

Most Latin American nations, including Argentina, were pushed into a lost decade of zero or negative economic growth. The values of the debts these nations owed suddenly increased; the cost of servicing the debts almost doubled; and the world went into recession. As a result, the potential to export goods to earn dollars to pay off the debts also diminished.

There was no default by Latin American countries, but widespread moratoria on debt payments were declared, starting with Mexico in 1982. Capital flows to Argentina and the rest of the region dried up.

At this time, the military junta, desperate for popular support as the economy unraveled, instigated the ill-fated war with the United Kingdom over the Malvinas (Falkland Islands). The failure of the war led to the collapse of the military regime and the return to democracy under Raúl Alfonsín. Mr. Alfonsín brought the military junta members to trial for human rights abuses. Many were convicted and sent to jail.

The Heterodox Shock Treatment

By the time the new democratic government took office, inflation had taken hold. There was widespread belief among the experts that a shock treatment was needed. Experts educated at the Massachusetts Institute of Technology, Harvard and Yale, then working in Brazil and Argentina, devised an economic “heterodox” shock treatment, which consisted of several economically heterodox government interventions: temporary wage/price controls to reduce inflationary expectations, a new currency, a conversion table to covert the longer-term contracts written in the old currency into the new currency and a slow reduction in the budget deficits. The idea was that the heterodox shock treatment would reduce expectations of continued inflationary instability and thus make the inflation more downwardly responsive to fiscal austerity programs. There would be, in theory, less pain from the gain in lower inflation under this plan.

At first the plan was a resounding success. Inflation was reduced. But the government failed to deliver on the longer-term fiscal adjustment in government spending. With the return to democracy, there were strong pressures on the Alfonsín government to ease up on fiscal austerity and to increase social spending. This government left office early, allowing the newly elected Carlos Memen to assume office amid the chaos of renewed inflation.

Carlos Menem and the Plan Cavallo

Carlos Menem had been jailed under the military dictatorship. One of his first acts as president was to give an indult, not a pardon, to the jailed members of the junta. Many thought this was a brilliant act. If Mr. Menem needed to create cohesion for economic reform, he needed to accept the fact that the military was part of the political process and to ensure their support.

His first foreign minister, Harvard-educated Domingo Cavallo, was appointed minister of the economy. Mr. Cavallo brought in a team from his Fundación Mediterranea to plan a new policy regime. There would be a new currency, set one-for-one with the U.S. dollar. The amount of currency in circulation would be equal to the amount of U.S. dollar reserves. The government’s central bank could no longer print up new money unless it had new U.S. dollar reserves from export surplus earning or inflows of U.S. dollar investments.

Again, the Cavallo Plan was a resounding initial success. Inflation vanished. Unfortunately, being linked to the U.S. dollar in the 1990’s proved not a very good idea, since the dollar appreciated very strongly. Argentine exports rose greatly in cost, and the country experienced a major competitive disadvantage to Brazil, which was not linked to the U.S. dollar. Besides, the central government failed to contain deficits by provincial governments, which began to run up large deficits. The Cavallo Plan eventually collapsed, and inflation returned with a vengeance.

After Mr. Menem left office, three failed presidencies followed. Eventually Nestor Kirchner was elected in 2003; he served for four years and was succeeded by his wife, Cristina Fernández de Kirchner. The Kirchner economic regime is a “back to the future” program of the 1950s-style import substitution policy, with strict controls on imports. Both Kirchners have been Peronists and have promoted “industrial development” and the formation of region-wide common markets.

The overall performance of Argentina stands in sharp contrast to that of Chile. Under Augusto Pinochet, many of the policies of the Chicago boys were implemented. When democracy returned following the fall of Mr. Pinochet in 1988, Chile was much more astute in keeping the best of the reforms and reshaping the other reforms.

The major lesson from this history of Argentina is that economics is never separate from politics. Argentina never was and never will be a blank slate for experts to try out their pet theories. Economics as a discipline is becoming more behavioral and historical, especially in understanding processes of economic growth. The overall success of economic development programs is the outcome of a search-and-learning process at the local level, not of “top-down” policies mandated by experts. Argentina has gone through much needless economic turmoil because of the dictatorship of tyrants and technocrats. Creating a climate of trust will likely take several generations. How soon Argentina emerges from the “middle-income trap”—the term for countries that are not desperately poor but still are not moving into successful growth—will depend on achieving a stable, sustainable climate in which political dialogue can take place amid a transparent search-and-learning process.