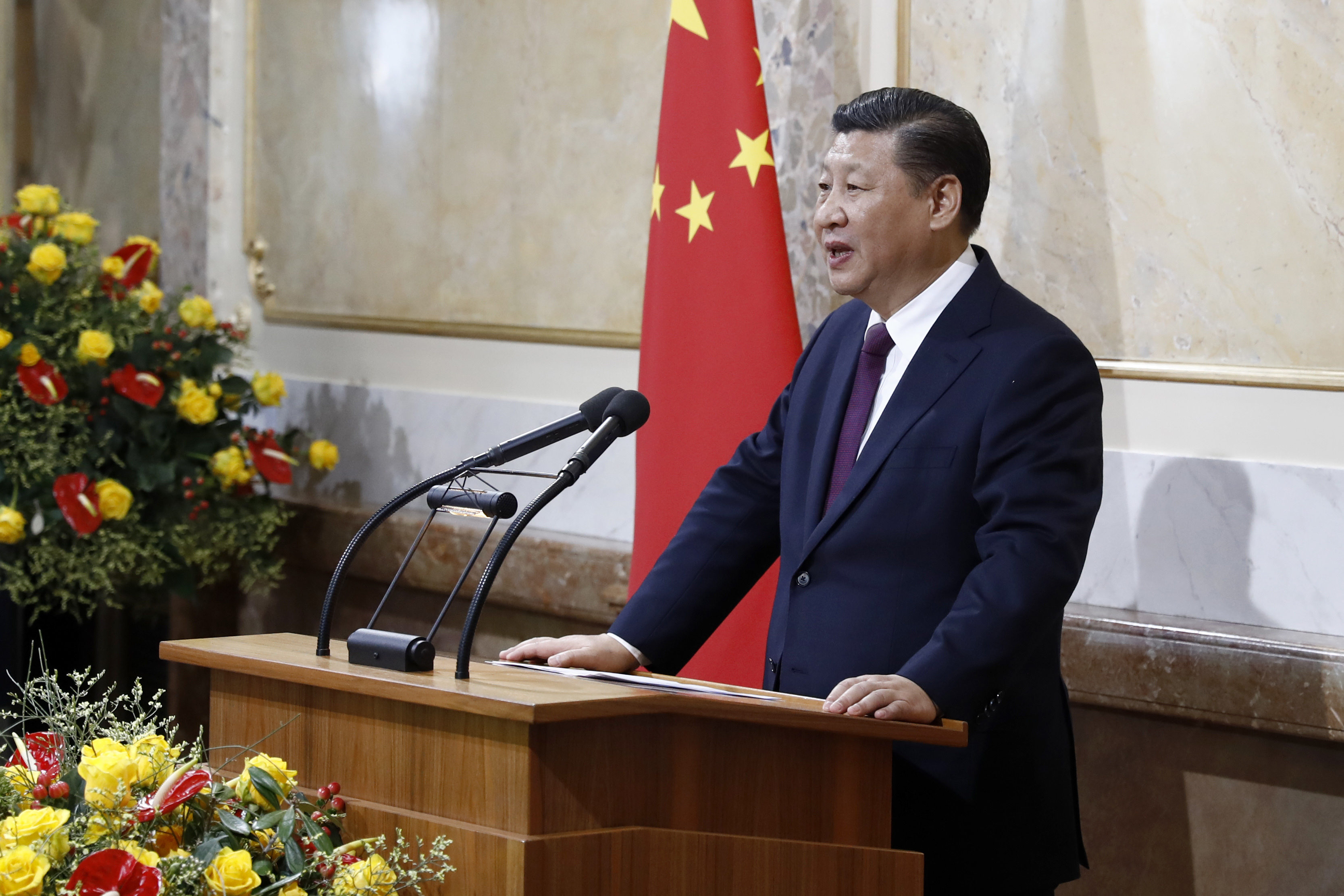

In his Inaugural Address, President Trump called on his listeners to “buy American, hire American,” stating that “protection will lead to great prosperity and strength.” During the same week, the Premier of China, Xi Jinping, stated that “pursuing protectionism is like locking oneself in a dark room; wind and rain may be kept outside but so is light and air.”

We are in the topsy-turvy world: Communists call for free trade while capitalist-country leaders call for more tariffs and trade restrictions.

Both leaders are engaged in real politik. Premier Xi realizes that China, along with much of Asia, has harnessed the economic growth available through free trade. President Trump, on the other hand, is playing to disaffected workers who blame free-trade agreements for job losses and trade deficits. But for all the soundbites of Trump’s address, the medicine of protectionism will do more harm than good.

Globalism and Raising Tariffs

The call for protectionism, immigration restrictions and disengagement from global alliances harkens back forebodingly to the Harding-Coolidge-Hoover era before the Great Depression. Of course, the world is different from that era: Over 90 percent of international trade is in intermediate goods, not final products. Imposing tariffs on intermediate goods raises the costs of production at home of home-produced goods, since many component parts are imported. Higher tariffs also render currently successful exports in the aerospace or automotive industry less competitive globally. For domestic consumers, costs for these durable goods will only rise, further squeezing family incomes.

Furthermore, the imposition of tariffs is never a one-shot game. There is the likelihood of retaliation from trading partners. The four largest U.S. exports to China, for example, are airplanes, soybeans, computer chips and educational services. If the United States imposes tariffs or other trade restrictions on China, China can order very similar high quality aircraft from Europe, import soybeans from Brazil, computer chips from South Korea or Japan and send students to higher education institutions in Australia. Is this what President Trump wants?

Global Savings Imbalances

The underlying cause of global trade imbalances—with persistent and large trade deficits in the United States and surpluses in Asia—rests with global savings imbalances. A continued trade deficit indicates that a country is absorbing more of the world’s resources than it is producing. By the same token a country running a persistent surplus is producing more of the world’s resources than it is consuming or investing at home.

The way to rebalance international trade is to increase savings in the United States and decrease savings in China. China’s savings rate, as a percentage of G.D.P., is over 50 percent, while the U.S. rate is less than 20 percent. Unfortunately, policies to change underlying savings behavior require long-term institutional and cultural change and more often than not meet hard political opposition.

Challenges to increasing US savings

In the United States, two policies that could go a long way toward increased savings rates would be the imposition of a federal consumption tax, similar to the national VAT taxes seen in Europe, and social security reform.

Consumption taxes tax citizens for the resources they take out of the economy, and not for what they contribute to the economy in the form of labor, implicitly encouraging a reduction in consumption. Consumption tax plans are wildly unpopular, however, as they are first and foremost regressive taxes. Lower and middle income families allocate more of their budgets to consumption than higher income families. Thus, an effective federal consumption tax plan is unlikely.

Restructuring social security could also increase savings behavior in the United States by forcing Americans to invest more. Singapore has a Social Provident Fund, which takes out of each paycheck up to 40 percent of income and invests these monies in a Sovereign Wealth Fund. These funds are managed in internationally diversified portfolios and provide pension support for the population.

Any switch from the American pay-as-you-go system to a fully funded system is a political nightmare. Were such a switch to take place, the current generation of workers would take a hard hit, having to pay off the current generation of retired workers while setting aside funds for investment for its own retirement. This form of social security is thus, also improbable.

Unlikelihood of savings reduction in China

Reducing the savings rate in China is even more difficult. The high savings rates there are, in part, a result of the nation’s gender imbalance, according to the competitive savings hypothesis created by Professors Shang-Jin Wei and Xiaobo Zhang of Columbia University. In 2007 the at-birth male/female sex ratio rose to 124 males per 100 females, a direct consequence of China’s one-child policy, which dates back several decades. Under that policy, many families opted to abort females in favor of males to continue the family name and provide for their own future.

The gender imbalance has made the marriage market competitive. Marriage-age males in China have to work much harder and longer, and save much more, in order to find an eligible and willing wife. High savings rates will likely persist in China as long as the high gender imbalance continues.

While the one-child policy has been relaxed recently in China, it is not clear how fast the one-child family will disappear. Habit persistently characterizes many facets of economic decision making, including family size, and habits do not change quickly. Furthermore, savings rates are likely to remain high in China because the lack of national health insurance and social security require citizens to support themselves with their savings.

Don’t Blame the Foreigners

The divergent savings behavior in the United States and China implies that trade imbalances are likely to persist for a long time. President Trump’s tough talk is unlikely to affect savings rates in either nation, and no elected political official in the United States is likely to adopt the reforms to the tax system or social security that could promote higher savings rates in the United States.

For all of his talk, President Trump has few cards to play with China when it comes to trade and savings imbalances. But in the end, China is not the problem; the problem is the profligate low savings behavior in the United States, which has gone on for decades, whose mirror image is the continuing trade imbalance. It is easy for political leaders to blame foreigners for these deficits and convince citizens that new trade deals with higher tariffs will be an effective remedy. But, as the Bible teaching goes, the problem lies within, not in the eye of the neighbor.

Hurdles to a higher savings rate don’t end with those noted in the article.

In 2012, national debt, as a percentage of GDP, reached its highest level since 1947. The middle class, after forty years of stagnant wages, has little if any chance of paying down the national debt on its own.

With shared sacrifice, the national debt dropped dramatically from 1947 to 1980. Shared sacrifice ended when tax cuts on the top 400 incomes lowered their federal income tax rate from 70% in 1980 down to 18% in 2010.

Some perhaps will blame the high national debt on government spending. However, 2012 federal spending, as a percentage of GDP, is unchanged from 1980.

Chuck

You inadvertently make the point of tax cuts.....you will never cut the debt down if you maintain the same percentage of GDP .

GDP must grow faster so that the percentage declines. The National Debt is so large now that a mere return to historic interest rates wil cause a spiraling up of that Total National Debt to catastrophic levels. You seem to think an increase in tax rates will allow GDP to rise faster than the combined increase in interest rates and additional government spending. Few if any economist would agree with your proposal since it is at odds even with typical Keynesian economics because you would crush "demand".

How would a 70% tax rate on the top 400 incomes crush the demand of 300 million consumers?

The problem with inequality is the top 400 incomes extract all the money from the middle class. Charles Koch notes our tax code subsidizes the wealthy. Please note that a million dollar brain surgeon salary falls $250 million short of "wealthy".

Chuck

I suggest you review the history of the famous Luxury tax on boats , jewelry and planes. It was suppose to raise $32 million in In new revenue, and teach the rich a lesson in equality ....When the dust settled it not only didn't' raise the $32million , the government lost $25 million in payroll and income tax revenue. Over 100,000 jobs were lost ("lost demand"). Not to mention the loss to states of sales taxes etc and required benefit payments to the newly unemployed. Why???. The production of these things simply moved offshore and demand just dried up .Try a tax of 70% on the top 400 earners and I will show you people who could move anywhere . More importantly I can show you many more people world wide who wouldn't consider relocating here , starting a business here, or expanding a business here..

Against whatever estimate you have for the extra $$$$$you would get from a70% tax you had best consider what you would most likely loose. If imposing such a tax just appeals to your sense of justice , I would like to remind you that paragon of equality Ted Kennedy sponsored the Luxury Boat tax and the crowed that the rich would finally be required to pay " their fair share". As noted above.....Kennedy's sense of "fair" managed to cost about 100, 000 people their jobs. The Luxury tax was promptly repealed but too late for those who had lost their jobs

Since it is statistics you seem to like , consider the following: Our National Debt is $20 Trillion.The top 400 earners ( the ones you seem to be fixated on ) hold approximately $2.34 Trillion in assets. If you were to confiscate ALL OF THESE ASSETS it would not put a dent in the National Debt.

And if you did that, you would forever forego all future taxes on those 400 amounting currently to over $30 billion per year!! I think it's called killing "the golden goose".

Even though the Luxury tax on boats etc was promptly repealed the US yacht industry was gutted.

I agree, the yacht tax flopped. However, if the yacht industry supported 100,000 jobs, imagine the potential of fifty million low wage workers making a living wage.

Stock buybacks consume four percent of GDP and benefit primarily the top .01% incomes. Diverting two percent of GDP from the .01% to low wage workers could raise fifty million workers up to a living wage.

Higher payroll tax revenue from 50 million employees alone would put $32 billion more into social security, about 10,000 times more than what the 400 top incomes contribute.

Why would a .01 per-center leave the country? If a .01 per-center does not sell $250 million in stock, there’s no capital gain and no tax.

If $1 million campaign contributions also drop, a 70% tax rate perhaps becomes free speech for the 99.99%. There's nothing illegal about free speech.

Chuck,

I see your preference for raising taxes, at least on corporations and/or the top household incomes. Here is what happens in a tax increase:

Dr. Christina Romer, professor of economics at the University of California, Berkeley, served as chair of President Obama’s Council of Economic Advisors during 2009 and 2010. She and her fellow researcher and husband, Dr. David H. Romer, studied all the tax changes passed since the end of World War II. In a paper published in The American Economic Review in 2010, they described the powerful impact of taxes on the economy:

“The most striking finding of this exercise is that tax increases have a large negative effect on investment..In short, tax increases appear to have a very large, sustained, and highly significant negative impact on output...The key results are that both components [investment and consumption] decline, and that the fall in investment is much greater than the fall in consumption.” Hardly sounds like a plan to help anybody.

“Hardly sounds like a plan (70% top tax rate) to help anybody.”

Did a 94% tax rate in 1944 help America’s greatest generation? Author Walter Scheidel in “the Great Leveler” notes “…as Roosevelt put it, ‘all excess income should go to win the war’…”

The top tax rate held at 91% from 1945 through 1963 and debt as a share of GDP fell dramatically. The top tax rate held at 70% from 1965 through 1981 and debt fell further. Debt as a share of GDP has risen nearly every year since 1981, the year the top tax rate fell below 70%. Debt as a share of GDP now exceeds that of 1947.

Chuck

Where to begin??......

The issue posed by Father Mc Nelis' Article is : "solving the US trade imbalance with China requires first growing US savings to compete with the Chinese "......

Your solution was TAX THE .01%.(..your preferred solution for every problem) to pay down the National Debt.

I pointed out that attempts to tax the .01%ers frequently resulted in shrinking GDP ( see the Luxury Boat Tax) and further that if you seized 100% of the assets of the .01%ers that you would 1) accomplish next to nothing to shrink the National Debt; 2) permanently loose an additional $30 + billion per year in taxes,;and 3)totally and finally zero out "the savings of the .01%ers!( when Father McNelis posits growing those very US savings as essential/integral to the trade imbalance issue). lastly I pointed out that .01%ers could and do move to avoid taxes and at you proposed 70% , many probably would

Now you shift the ground totally and go to "stock buy backs" as the source of the growing National Debt and poor savings rate. You start by claiming "stock buy backs consume 4% of GDP . That claim is based on an article in The Atlantic (Feb 2015) which claims that without " stock buy backs" more money would be reinvested and paid in wages. The fallacy is that The Atlantic author thinks wages are solely a function of accumulated corporate profits and not the supply and demand for labor. That argument is Econ 101 nonsense. Think Apple with $260 Billion in cash; Microsoft with $ 110 Billion; Google with about $80 Billion....and an estimated $250 to $300 Trillion offshore because of USTaxes! If cash on hand correlates to higher wages then the employees of these companies would have soaring salaries....they don't!

You claim "the stock buy backs" only benefit the .01% ers when all available evidence demonstrares that a little over half of all Americans are in the Stock Market ((CNBC oct 6, 2016).

Further, more and more Americans will be exposed to the stock market through 401K Plans! And "buy backs" force capital gains to be paid by sellers. This puts a portion of the "buy back money" right into the Treasury!

You can't use taxes to grow "savings or GDP"...., taxes grow government; and rarely (very rarely) government is able to use its tax receipts to grow GDP .

"…solving the US trade imbalance with China requires first growing US savings to compete with the Chinese…"

A 70% tax rate on the top .01% incomes may bump savings up $90 billion annually.

A $15/hour living wage for fifty million low wage workers adds $30 billion to social security, possibly their only retirement “savings”.

You suggest a 70% income tax rate on top .01% incomes would cost $30 billion in federal tax revenue. If the .01% no longer pay $30 billion annually in taxes, perhaps their savings would increase $30 billion rather than go to zero.

Finally, 99.99% of taxpayers could save $30 billion annually that previously went toward benefits for fifty million low wage workers.

Chuck

If all their assets and income were seized to reduce the National Debt , th e .01%ers would no longer pay @ $30 billion in taxes precisely because they no longer had any source of income....zero..Nadda .

No income= No savings.

The concept that "taxes" create a source for, or add to "savings" is utterly contradictory.

Further, the benefit in shifting income into to the lowest wage earners is that it will be spent by them, not that it will be saved. It is the preferred liberal solution for creating an increase in demand for goods and services. .....see Paul Krugman. Such a shift does not create "savings". Father McNelis' point was precisely that we need to increase savings and do things differently to accomplish that purpose.

If the .01 percenters no longer have $100 million incomes from capital gains, perhaps they collect unemployment until they get a job. Washington may well "do things differently" if the .01 percenters no longer appear on the top ten donors lists for 535 members of congress.

Chuck

And what exactly will this last suggestion of yours concerning the $.01ers accomplish in the context of "Trade Imbalance with China"....the subject of this article?

I get it!......you despise the $.01ers, their wealth, and their influence.....but what benefit would their total elimination bestow on our National economy or interests. .i understand you would feel better.

And what exactly will this last suggestion of yours concerning the $.01ers accomplish in the context of "Trade Imbalance with China"....the subject of this article?

The top $.01ers' incomes and trade imbalances have grown dramatically since 1981. Guess the year of our last trade surplus…1981.

“I get it!......you despise the $.01ers, their wealth, and their influence.....but what benefit would their total elimination bestow on our National economy or interests.”

America’s greatest generation did not leave us a national debt at 120% of GDP. Perhaps it’s time another generation follow in their footsteps.

Chuck

By definition when there is a trade imbalance with China it means we are exporting money to China in exchange for goods faster than we are importing money from China by selling goods. It is an economic oxymoron to suggest that US $. 01ers are gaining in wealth by trade imbalance with China unless they happen to own ALL the Chinese export factories. Like everyone else the $.01ers ship money out of the country to the extent that they buy foreign goods.

The fact that you can find a series of statistics that on a gross time basis of 25+ years coincide with the $.01ers' growth in. income is not in any fashion demonstrative of a causal relationship between them. There has been a dramatic increase in the survival rate for breast cancer between 1981 and 2016, but that hardly means that the increase in that period of the $.01ers wealth was the cause of such decline. Or for that matter that their increase in wealth was caused by those survivors. Please see the article "National Debt Year to Year Compared to GDP" in THE BALANCE July 31,2017 .........if you can find or demonstrate any causation or even. correlation between these significant fluctuations in % of GDP represented by the National Debt and the incomes of the $.01ers please do so.

The only generation that can reverse the increase in the National Debt as a % of GDP is a generation that grows GDP at a significantly faster the automatic increase in the National Debt caused by borrowings to pay interest on that National Debt. The corollary is a need to reduce government spending/borrowing!

“It is an economic oxymoron to suggest that US $. 01ers are gaining in wealth by trade imbalance with China…”

How soon can we see “Made in the USA” on everything at Wal-Mart? With a $150 billion majority stake in Wal-Mart, the Walton family can switch to “Made in USA” anytime they want.

How is federal spending a problem? Federal spending as a percent of GDP in 2014 is virtually identical to that of 1953. A 91% top income tax rate in 1953 lowered debt while a 23% top tax rate in 2014 increased debt. The tax system is broken.

Chuck

Your statistics are wrong and they do not correlate to any conclusion you have pushed.

The top tax rate in 2014 was not 23%..... it was 39% without the ObamaCare surcharge on capital gains of 3.8% .

The source of lower debt In 1950 is the far smaller annual Federal Budget Generating small current deficits. These budget deficits are a direct reflection of Federal Spending!!! The larger debits of today reflect higher spending rates

Please keep in mind that contrary to all ordinary accounting practices the Federal Balance Sheet does not include the unfunded liabilities it has incurred for: 1) Pensions;2)Medicare; 3) Social Security. The Feds simply borrow at interest for the monies to pay these sums annually as they become due. These are the unfunded...so called entitlements that control the budget. If the Feds ever had to borrow enough to fund these liabilities, then the Federal Government's interest rate payments would soar beyond comprehension and the Balance Sheet would be in bankruptcy !